Rome – For the Israeli Institute for National Security and Zionist Strategy there is currently a unique and rare opportunity to evacuate the entire Gaza Strip in coordination with the Egyptian government and for this reason they have developed a plan for resettlement and definitive rehabilitation in Egypt of the entire population of Gaza and evaluated its economic aspects.

The document was drafted by Amir Weitman, president of the libertarian faction of the Likud party in power in Israel and investment manager as well as researcher at the Meshgav Institute for National Security and Zionist Strategy.

HERE IS THE FULL TEXT OF THE PLAN IN ENGLISH

A plan for the resettlement and definitive rehabilitation in Egypt of the entire population of Gaza. Economic aspects There is currently a unique and rare opportunity to evacuate the entire Gaza Strip in coordination with the Egyptian government.

A plan for the resettlement and definitive rehabilitation in Egypt of the entire population of Gaza. Economic aspects There is currently a unique and rare opportunity to evacuate the entire Gaza Strip in coordination with the Egyptian government.

This document will present a sustainable plan with high economic feasibility, which is well aligned with the economic and geopolitical interests of the State of Israel, Egypt, the United States and Saudi Arabia.

A summary of an immediate, realistic and sustainable plan for humanitarian resettlement and rehabilitation actions of the entire Arab population in the Gaza Strip.

In 2017, it was reported that there are approximately 10 million vacant housing units in Egypt, of which approximately half are built and the other half are under construction.

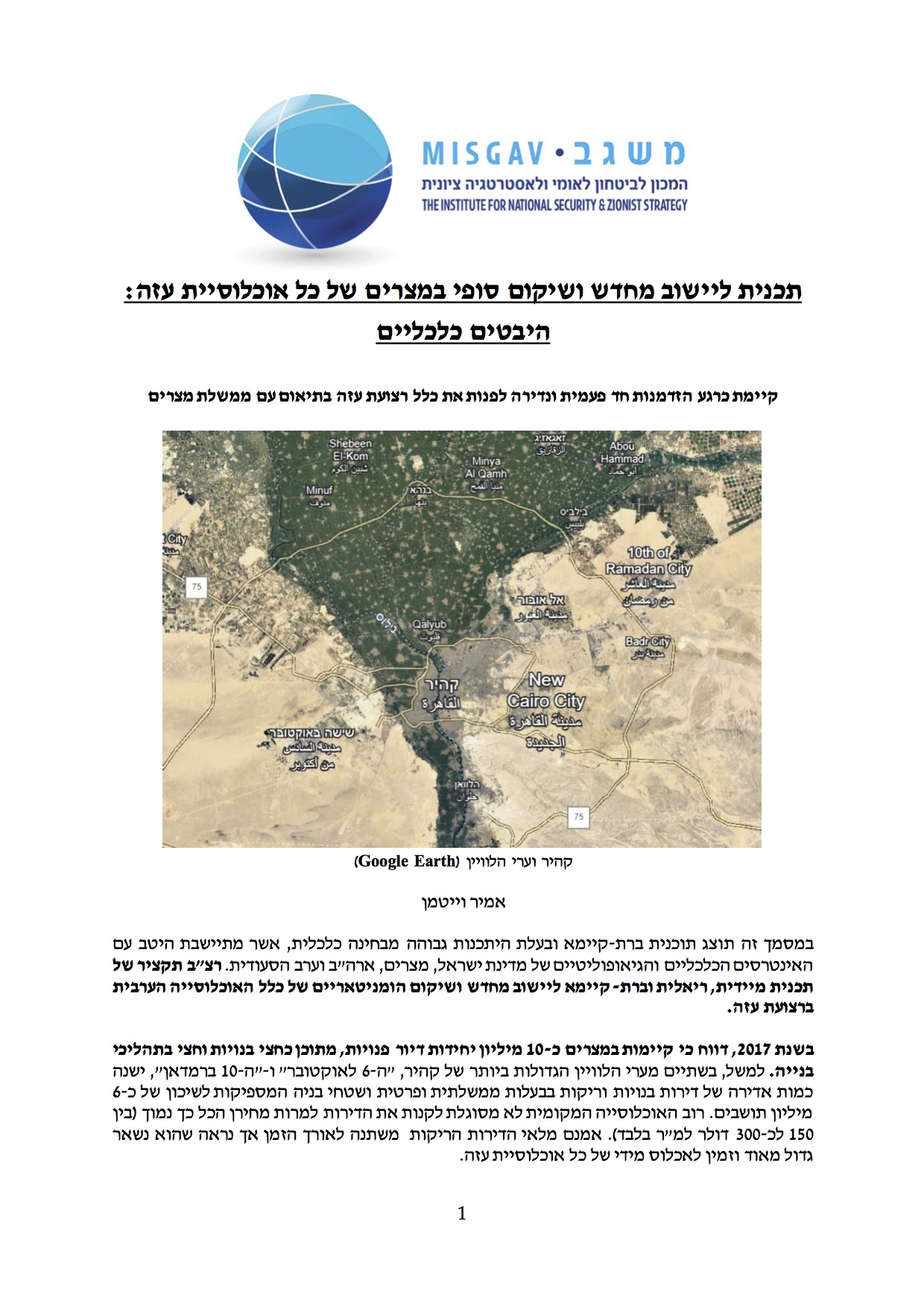

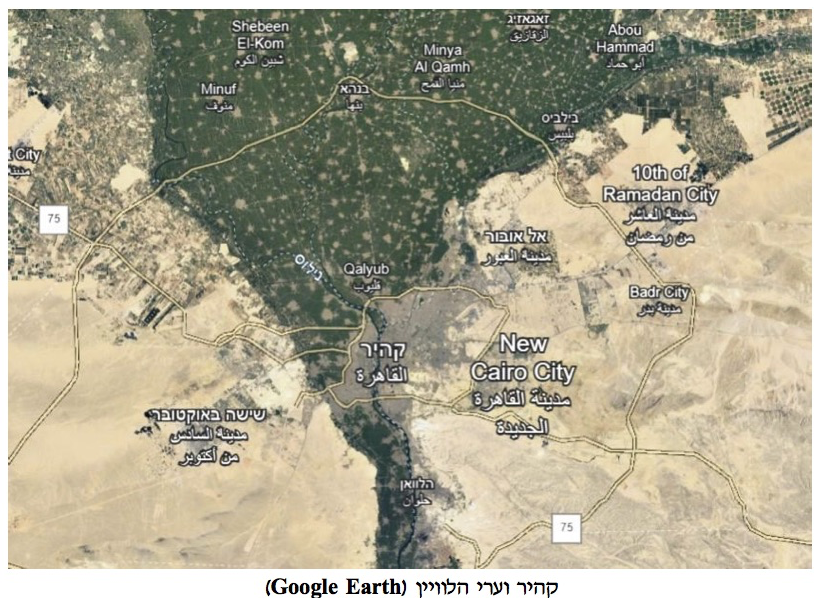

For example, in Cairo’s two largest satellite cities, “The 6th of October” and “The 10th of Ramadan”, there is a huge amount of built and empty apartments owned by the government and private individuals and sufficient building areas to accommodate about 6 people. millions of inhabitants.

Most of the local population is unable to purchase apartments despite their very low price (only between 150 and 300 dollars per square meter). Although the stock of empty apartments changes over time, it appears to remain very large and available to be inhabited by all of Gaza’s population.

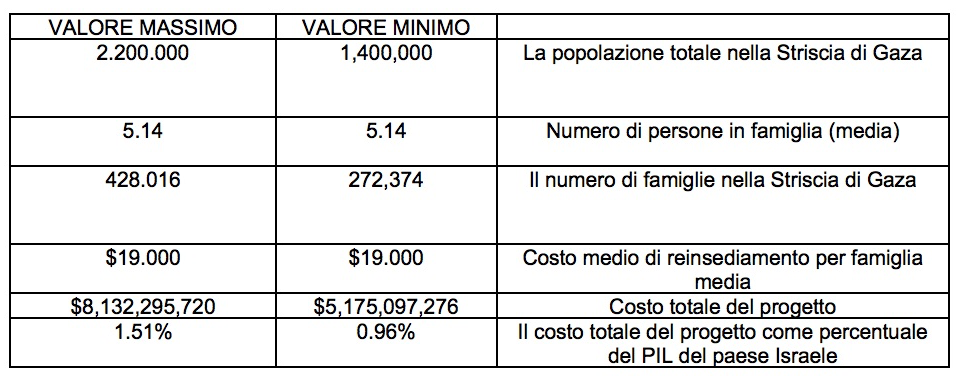

The average cost of a 3-room apartment with an area of 95 square meters for an average Gazan family of 5.14 people in one of the two cities indicated above is approximately $19,000, taking into account the currently known extent of the entire population. live in the Gaza Strip, which amounts to approximately 1.4-2.2 million people, it can be estimated that the total amount that will be necessary to transfer to Egypt to finance these projects is in the order of 5-8 billion dollars.

The amount reflects a value between only 1% and 1.5% of the GDP of the State of Israel and can be easily financed by the State of Israel, even without any international aid. As will be explained in the next paragraph, injecting an immediate stimulus of this magnitude into the Egyptian economy would provide an enormous and immediate benefit to the al-Sisi regime.

These sums of money, in relation to the Israeli economy, are minimal. If this helps to move the pill for Egypt, it is also possible to double, triple and even quadruple them to resolve the issue of the Gaza Strip, which for years has represented an obstacle to peace, security and stability not only in the Gaza Strip , but also throughout the world: investing single billions of dollars (even if it is 20 or 30 billion dollars) to solve this difficult problem is an innovative, economical and sustainable solution.

In this context, it is worth mentioning that the State of Israel spent around 200 billion shekels in less than a year to treat the Corona epidemic.

There is no reason to believe that we will not be able to afford an immediate payment of 20-30 billion shekels, which is basically a kind of payment for the purchase of the Gaza Strip, and to which we can still add a lot of value over time, so much so that it actually constitutes a very useful investment for the State of Israel.

The conditions of the Gaza territory, similar to those of the Gush Dan area, will allow many Israeli citizens to live at a high level in the future and will effectively expand the Gush Dan area to the border with Egypt. It will also give a huge boost to settlements in the Negev. Income statement – Egypt: On 12/16/2022 the International Monetary Fund approved a rescue loan of 3 billion dollars for Egypt in the face of the worsening of the economic crisis it is experiencing (in 01/2023 Egypt rose at 26.5%) but is conditioned by draconian conditions and reforms in the Egyptian economy.

Although the IMF has recommended moving to a flexible exchange rate, this approach is expected to exacerbate the inconvenience and even worsen cost-of-living problems.

Since 03/2022, the Egyptian pound has lost about half of its value (the official dollar exchange rate has increased by 95%, from 15.7 to 30.7 pounds per dollar, much less than the black market rate) , and this depreciation in the value of the currency has already damaged the Egyptian economy by significantly inflating the costs of importing food products into the country (around 70% of the Egyptian population, who live on an income of a few dollars a day, survive by buying bread and government-subsidized basic necessities).

The private sector in Egypt is struggling to recover and its production has been declining steadily for 26 consecutive months.

The loan is also conditional When the privileges they receive are companies owned by the army, which could endanger the al-Sisi regime. In light of these data, the IMF recommendations encounter strong opposition and, at the same time, their implementation appears highly unlikely given the risk they pose to the stability of the al-Sisi regime.

It seems that the Egyptian government intends to sell its stakes in 35 state companies to strategic investors by the end of 06/2024, when at the time of writing these lines, An amount of approximately 5 billion dollars has been raised, with an additional 5 billion dollars intended for collection. “If the Egyptian government succeeds in promoting the issuance plan and securing additional financing from Gulf countries or other partners, the Egyptian central bank will adopt a more flexible exchange rate policy,” economist Hani Abdul-Fathuh told Ahram Online.

The second IMF loan audit date was scheduled for mid-September, but the first date, scheduled for the month of 03/2023, did not take place at all. About these two audits To be carried out before the annual meeting of the IMF International and World Bank Group in Morocco on 8/10,” Fatuh underlined. Egypt’s debt is equal to 6% of GDP for the fiscal year 2022-2023, its debt/GDP ratio has been estimated in recent years at 95.6%, with a GDP of 9.8, equal to approximately 318.23 billion dollars. The value of Egypt’s net foreign asset deficit reached $26.34 billion in 07/2023.

(The value of the net deficit in foreign assets reflects the net value of foreign assets held by state banks minus their foreign liabilities.) A-Sisi regime faces intense pressure to repay its debts, amid low confidence of investors.

Furthermore, on 05/10/2023 the rating agency Moody’s downgraded Egypt’s credit rating from B3 to Caa1, meaning that the Egyptian government’s debts are “significant risk”. This is the lowest score ever awarded to Egypt. China is the fourth largest debtor of the Egyptian government, with a debt of $7.8 billion as of 06/2023. Egypt expects to receive a loan worth about half a billion dollars in bonds, made up mainly of Chinese yuan to help it meet its obligations.

Most of the funding for the “Egypt New Capital” project, which involves moving all government offices to a new city with advanced construction processes in the desert east of Cairo and vital to Sisi, comes from Chinese loans and commissions estimated at $4 billion, with high returns and large redemption payments that Egypt already has difficulty meeting.

Therefore, China has also started to show caution in investing in Egypt in light of the financial challenges the latter is facing. However, even if China decides to start reducing its investments, it would still want the “Egypt New Capital” project and other projects to be completed.

China is currently focused on relations with the Gulf states, while Egypt’s economic survival is an important issue for the latter. In a scenario where Egypt is deeply indebted to China, there will be significant and far-reaching geopolitical consequences for the region.

This is of great concern to the United States, because Egypt’s failure to comply with its obligations to China, and as a result, China’s acquisition of strategic assets in Egypt, will be a strategic disaster for the United States.

Egypt’s other creditors, such as Germany, France and Saudi Arabia, also do not want to see a total failure of the Egyptian economy, so they too will have an incentive to keep the Egyptian economy above water, even if through Israeli investments in the rehabilitation of the entire population of Gaza in existing apartments in Egypt.

For European countries, and in particular those of Western Europe, the transfer of the entire population of Gaza to Egypt and its rehabilitation, significantly reducing the risk of illegal immigration into their territory, represents a huge advantage.

Saudi Arabia is also expected to benefit significantly from this move because the evacuation of the Gaza Strip means the elimination of an important ally of Iran and a huge contribution to the stability of the region, thus offering the possibility of promoting peace with Israel without the constant interference of local public opinion Due to the continuous and repeated clashes that light the fire of hatred against Israel. Furthermore, there are countries, such as Saudi Arabia, that need qualified construction workers, like the inhabitants of Gaza.

Saudi Arabia is building big projects and the city of the future Naum, and this could be a crossroads of interests at this level too. It can be assumed that quite a few Gaza residents would jump at the opportunity to live in a rich, advanced country rather than continue to live in poverty under Hamas rule.

This agreement between Egypt and Israel can be reached within a few days of the start of the flow of immigrants from Gaza to Egypt through the Rafah crossing.

Already today, hundreds of thousands of Gazans wish to leave the Strip. The IDF must create the right conditions for Gaza’s population to immigrate to Egypt, with Egyptian cooperation on the other side of the border (and for an adequate return).

Furthermore, closing the Gaza issue will ensure a stable and increased supply of Israeli supplies. gas to Egypt and its liquefaction, as well as greater control by Egyptian companies over the existing gas reserves off the coast of Gaza together with the transfer of Gaza emptied of its inhabitants to the State of Israel.

Gaza’s total population, about 2 million, makes up a smaller total.

There is no doubt that for this plan to be realized many conditions must coexist at the same time.

Currently, these terms are taking place and it is unclear when such an opportunity will arise again, if at all.

This is the time to act. Now.

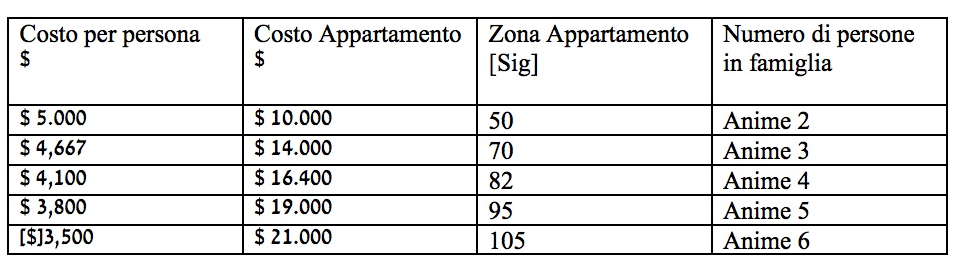

Resettlement cost per person/family in Egypt and total cost to Israel as a percentage of GNP for fiscal year 2023

Appendix B’ Average cost per apartment in resettlement targets, broken down by apartment size